UMMI Payment Solutions - Making Small the New Big

The ‘Internet of Things’ has vastly transformed the way businesses are being transacted. UMMI would start from the most fundamental element in every business, which is ‘Payment’, making every payment between individuals and businesses simple, faster, secure and seamless with omni- channel user experience. We believe that understanding customer needs would continue to drive innovation.

Our Services

1. Micro Solution

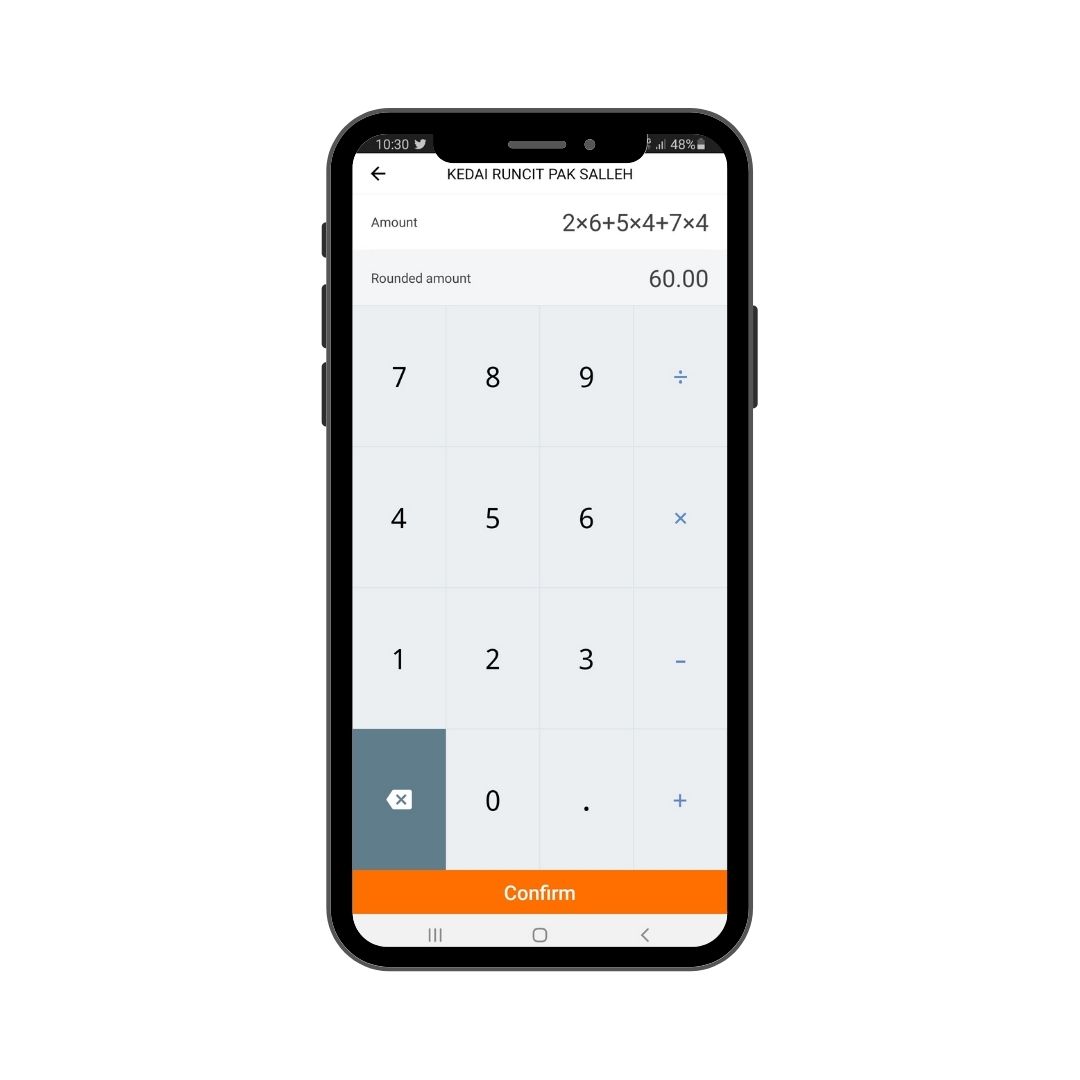

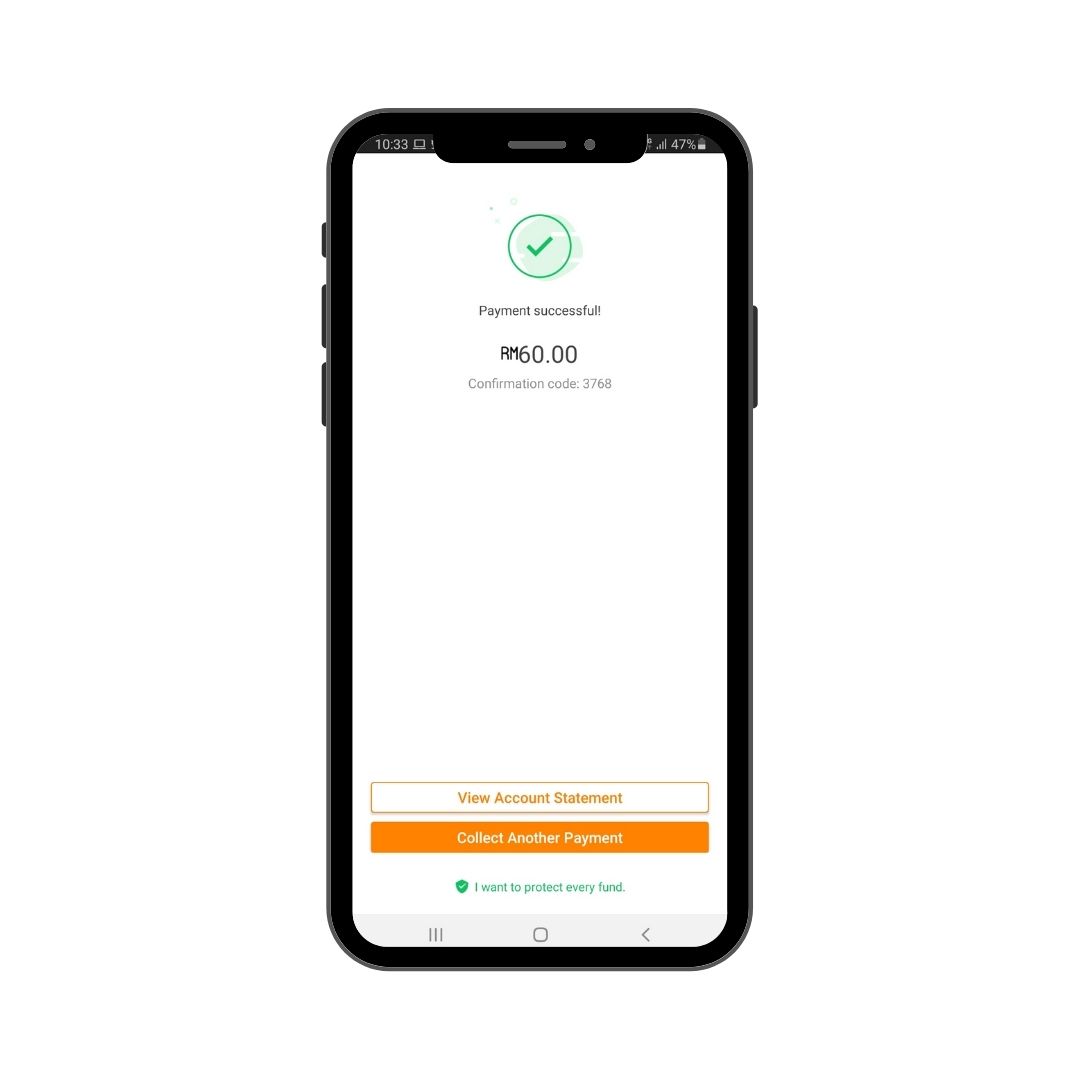

Simply Sum & Scan

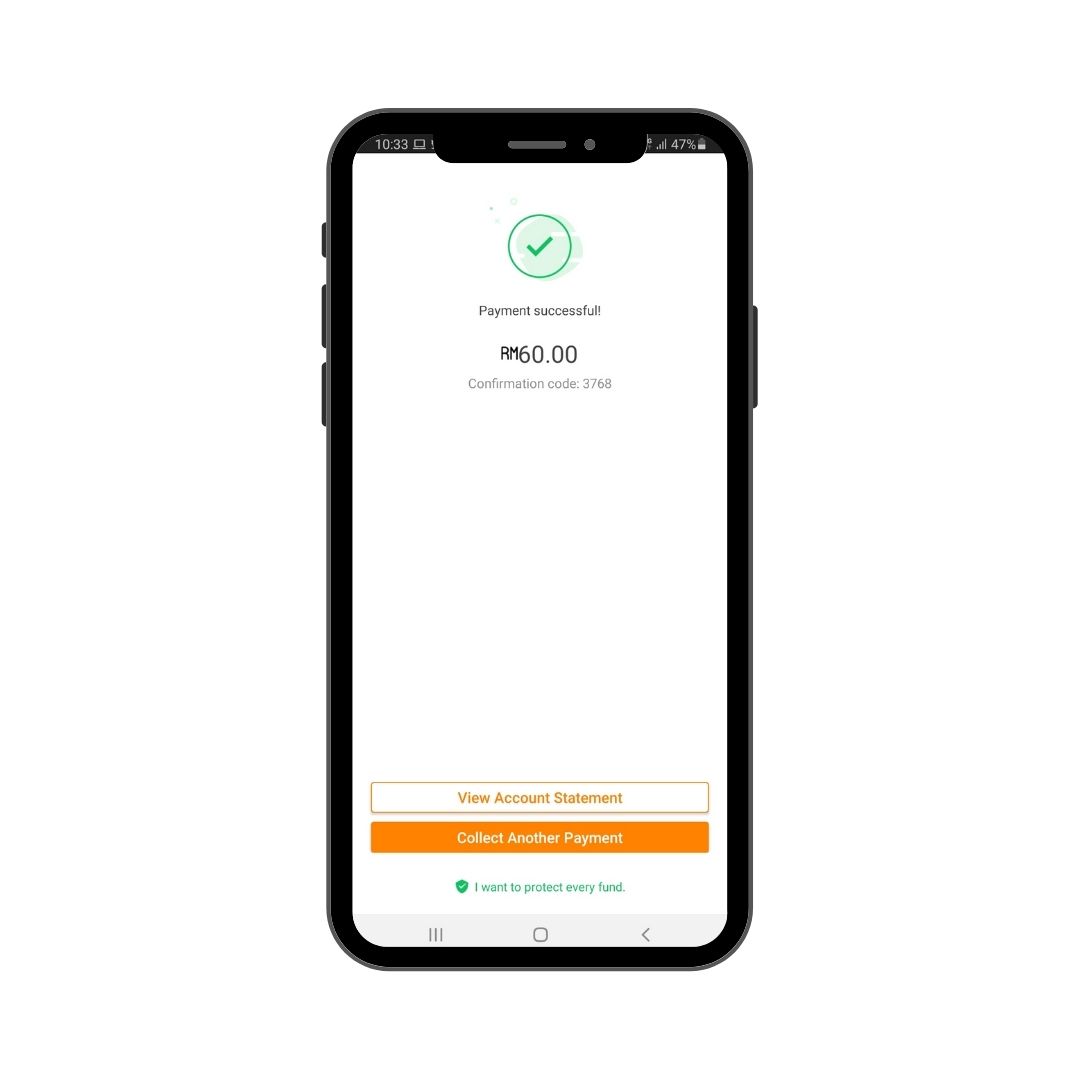

- Fast– It makes cashless faster than cash

- Easy– Zero learning curve

- Payment aggregation– Aggregates cashless payment eg. Duitnow or e-wallets

- Membership – Keeps data on customers for engagement

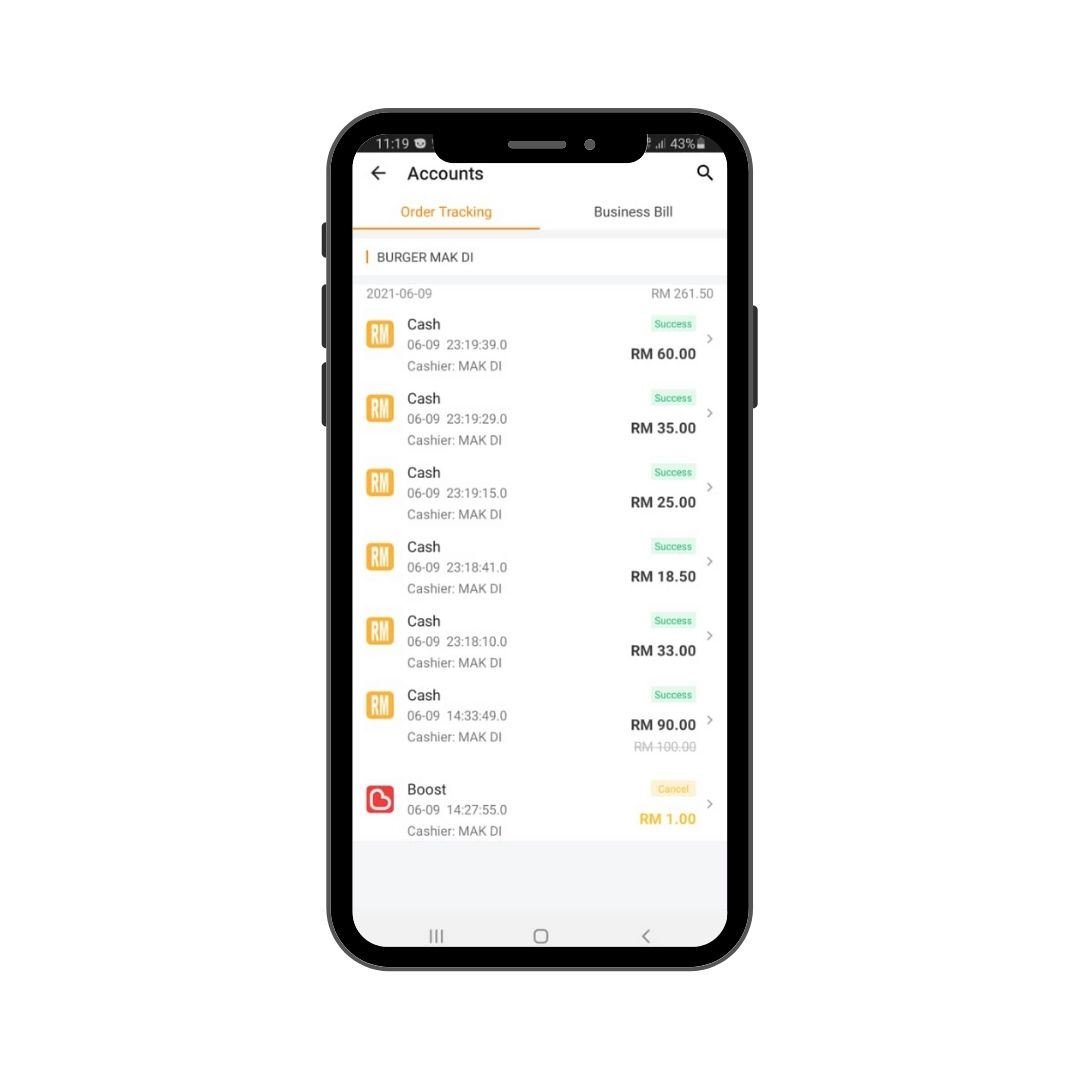

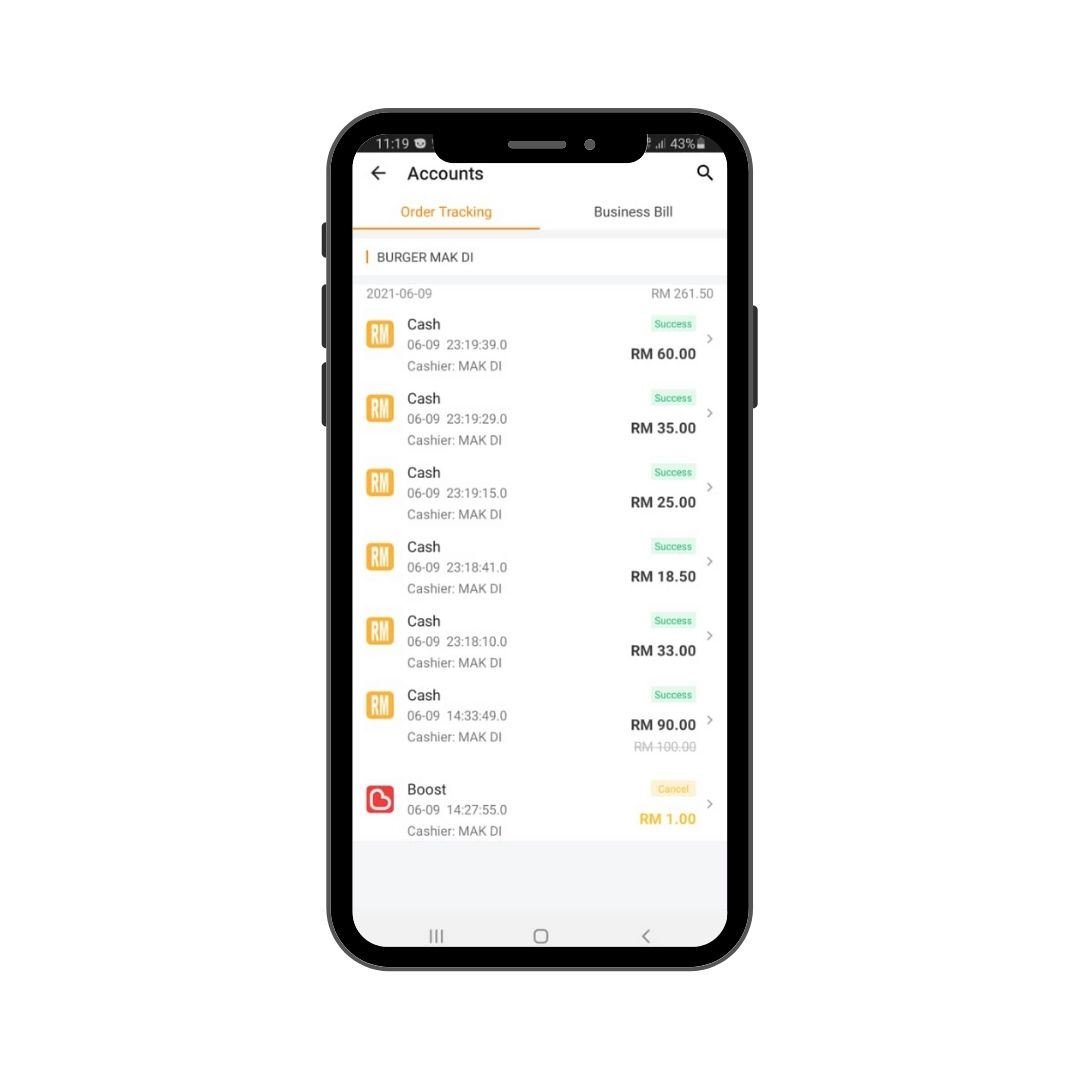

- Digital– Keeps digital record for cash and cashless transactions

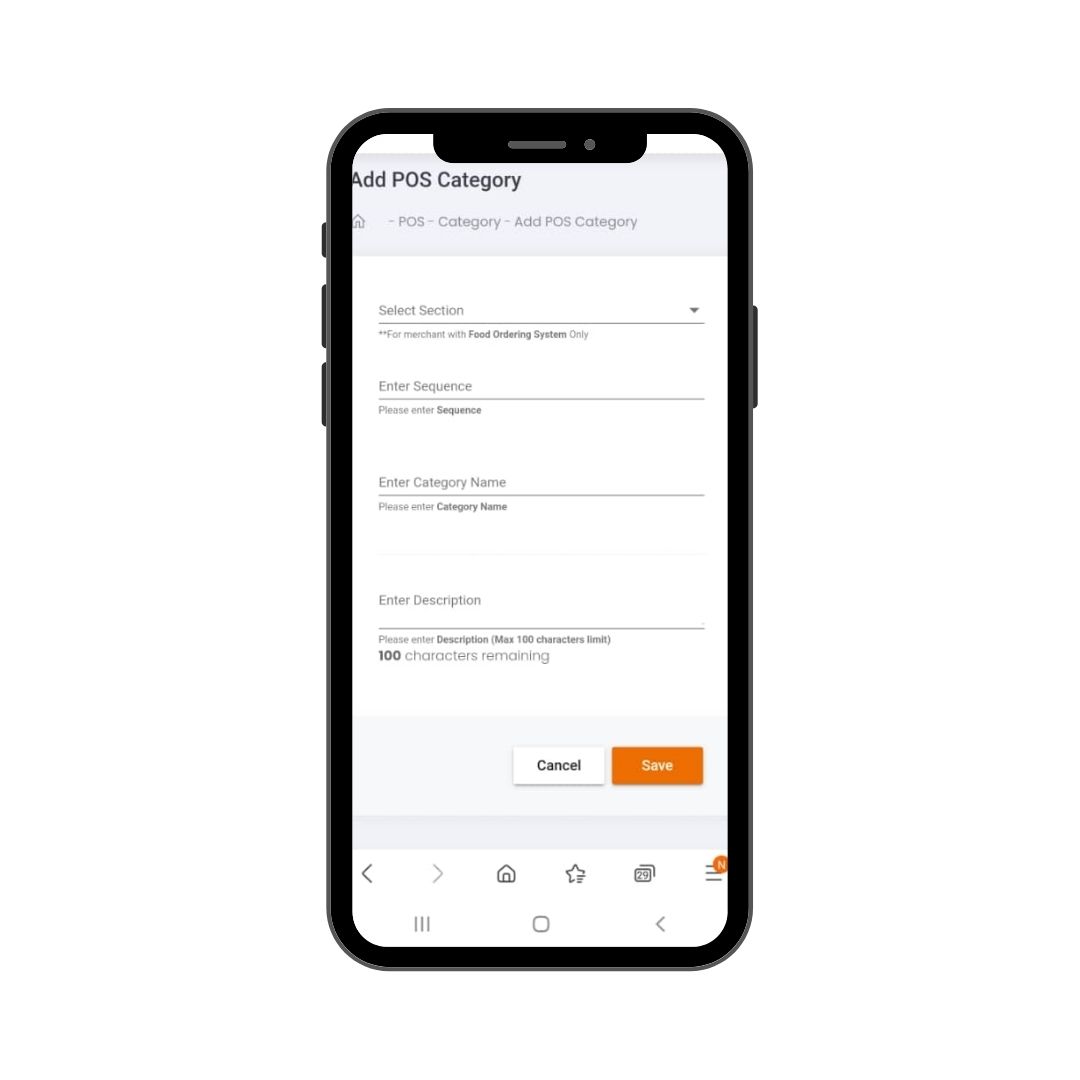

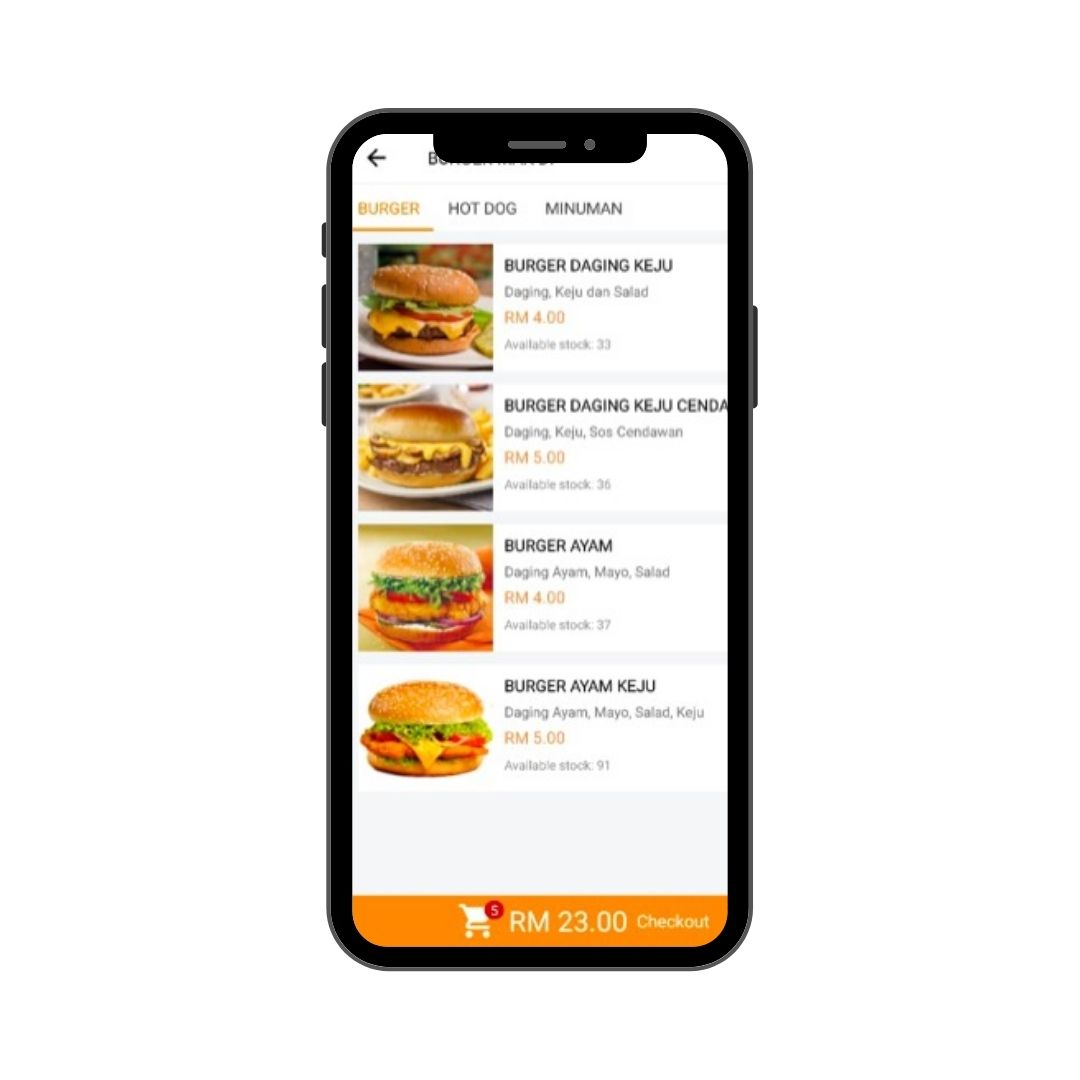

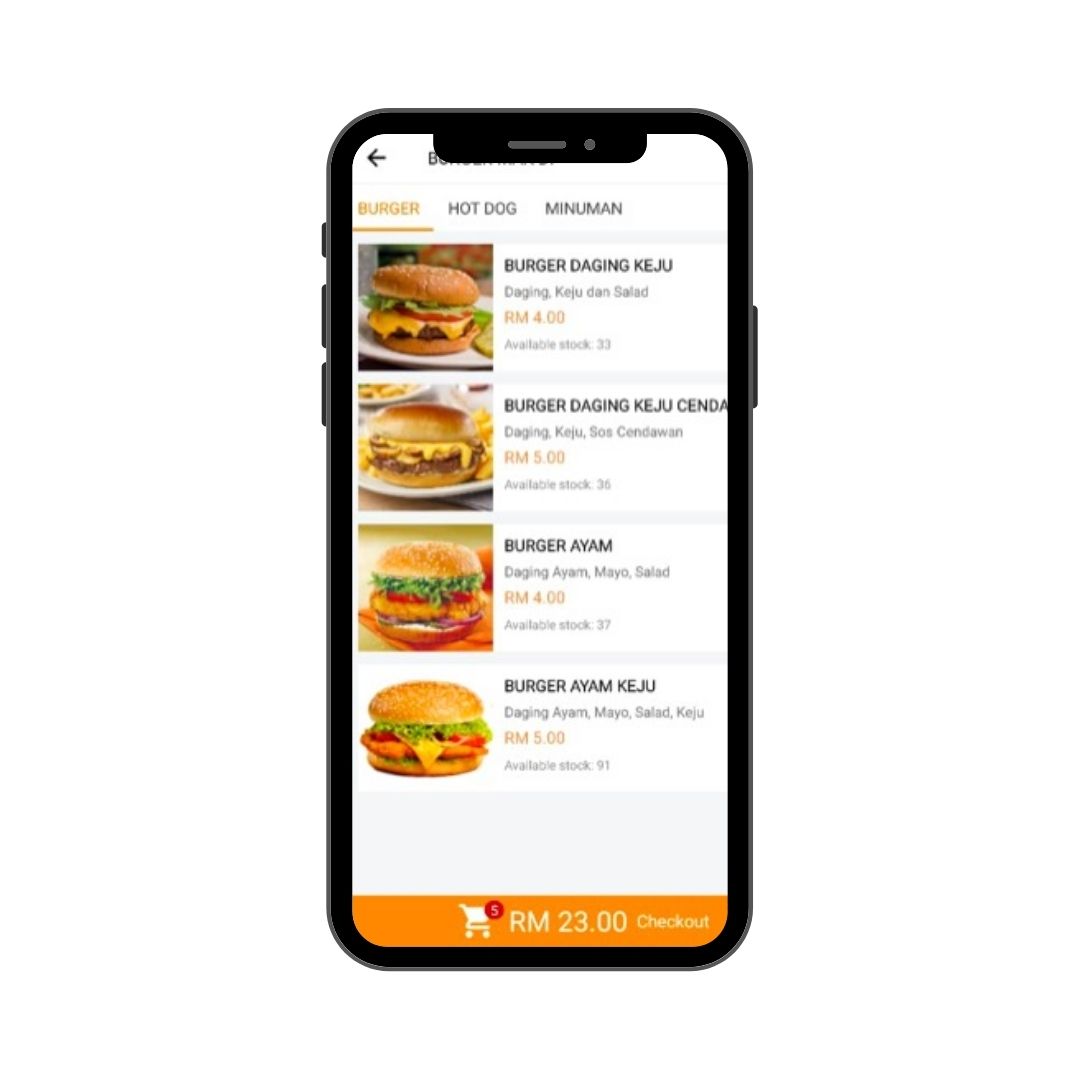

2. Point of Sales (POS) Solution

Simple POS for all

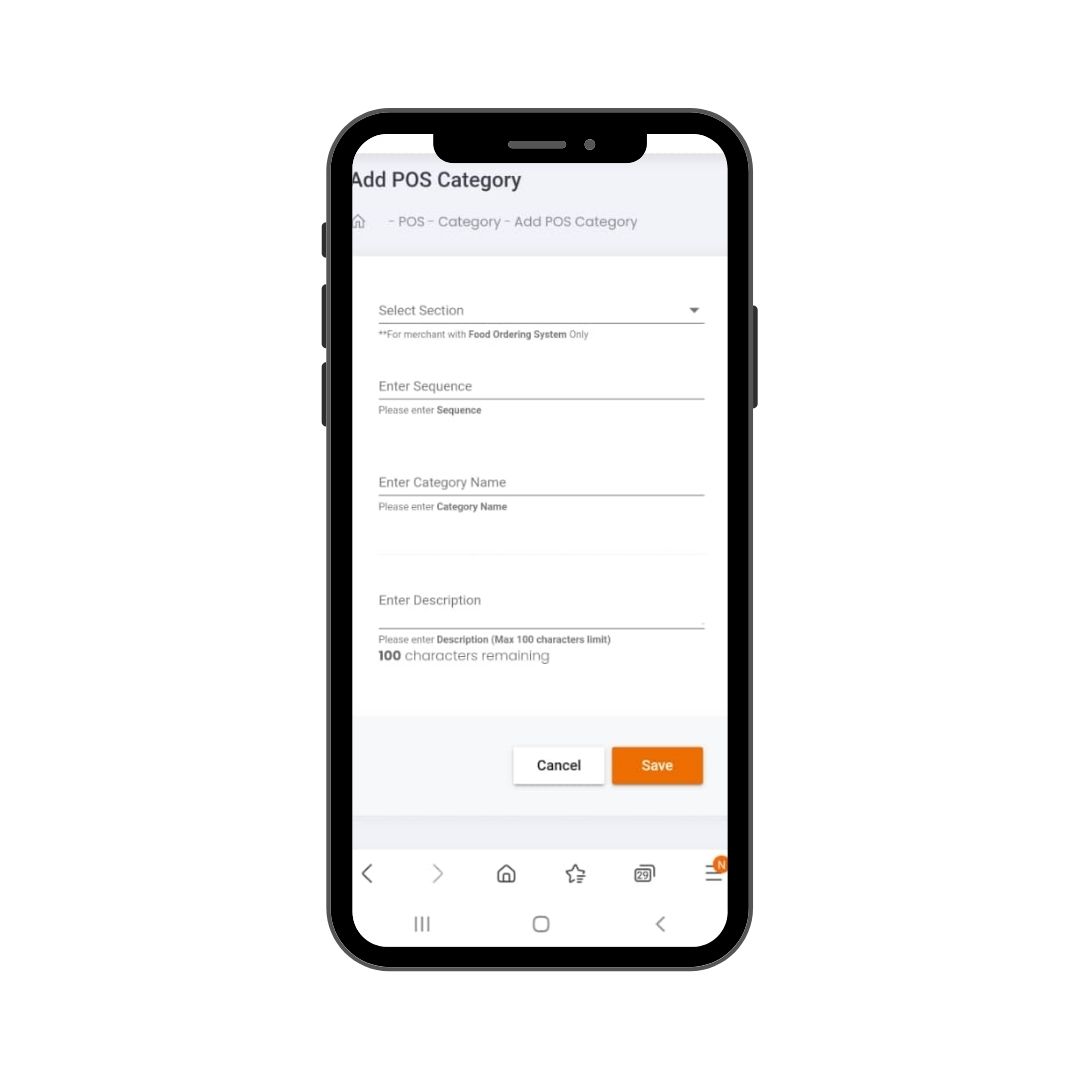

- Savvy merchants– POS feature is for savvy merchants. Merchants can upload product in the backend, create SKU and post items on POS

- Fast and accurate– POS makes posting of sales faster and accurate without the use of calculator

- Inventory tracking– Merchants can keep track of items sold and manage inventory

- Payment aggregation– Merchants can receive cashless payment from Duitnow and various e-wallets

- Membership– Keeps data on customers for engagement

- Digital data – Keeps digital record for cash and cashless transactions

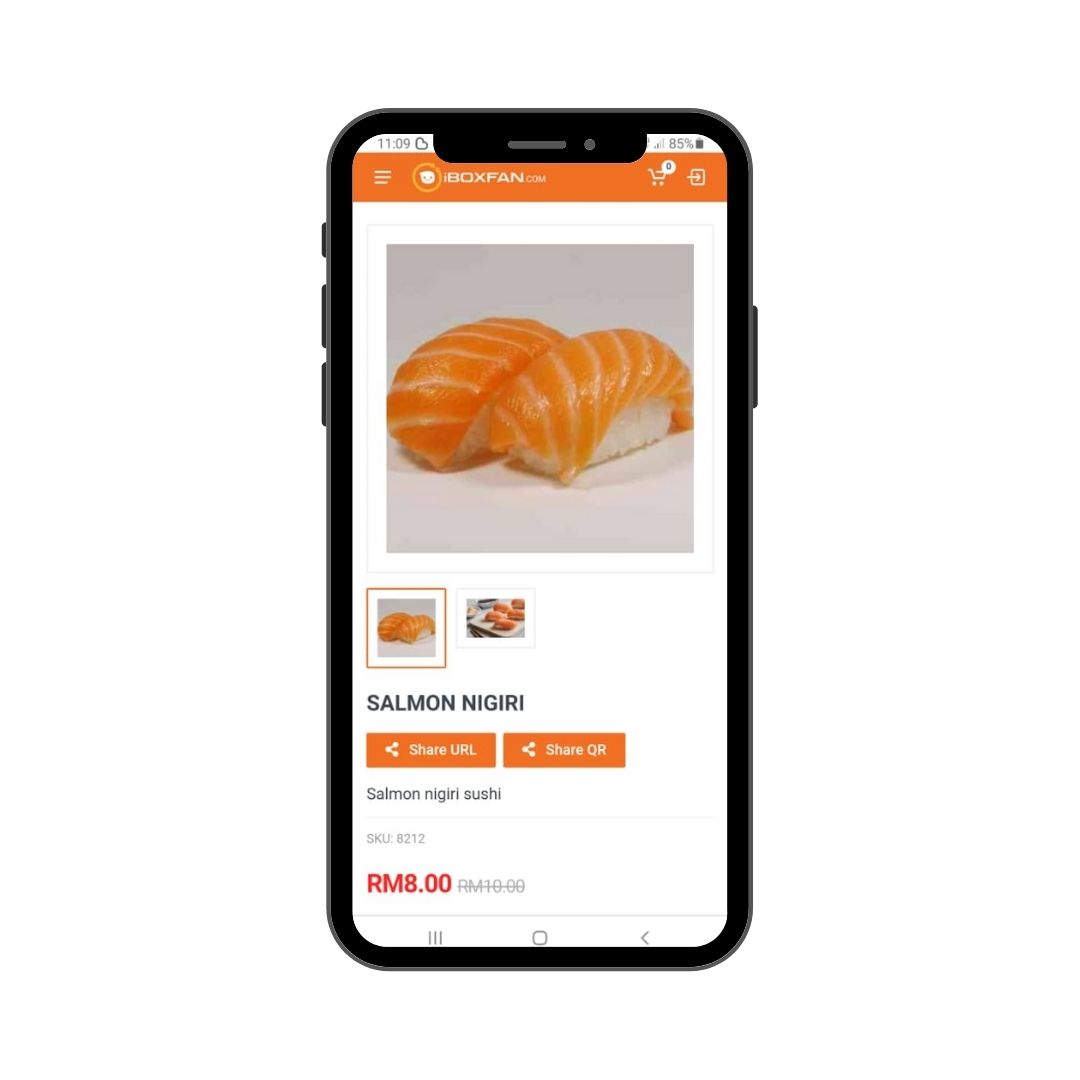

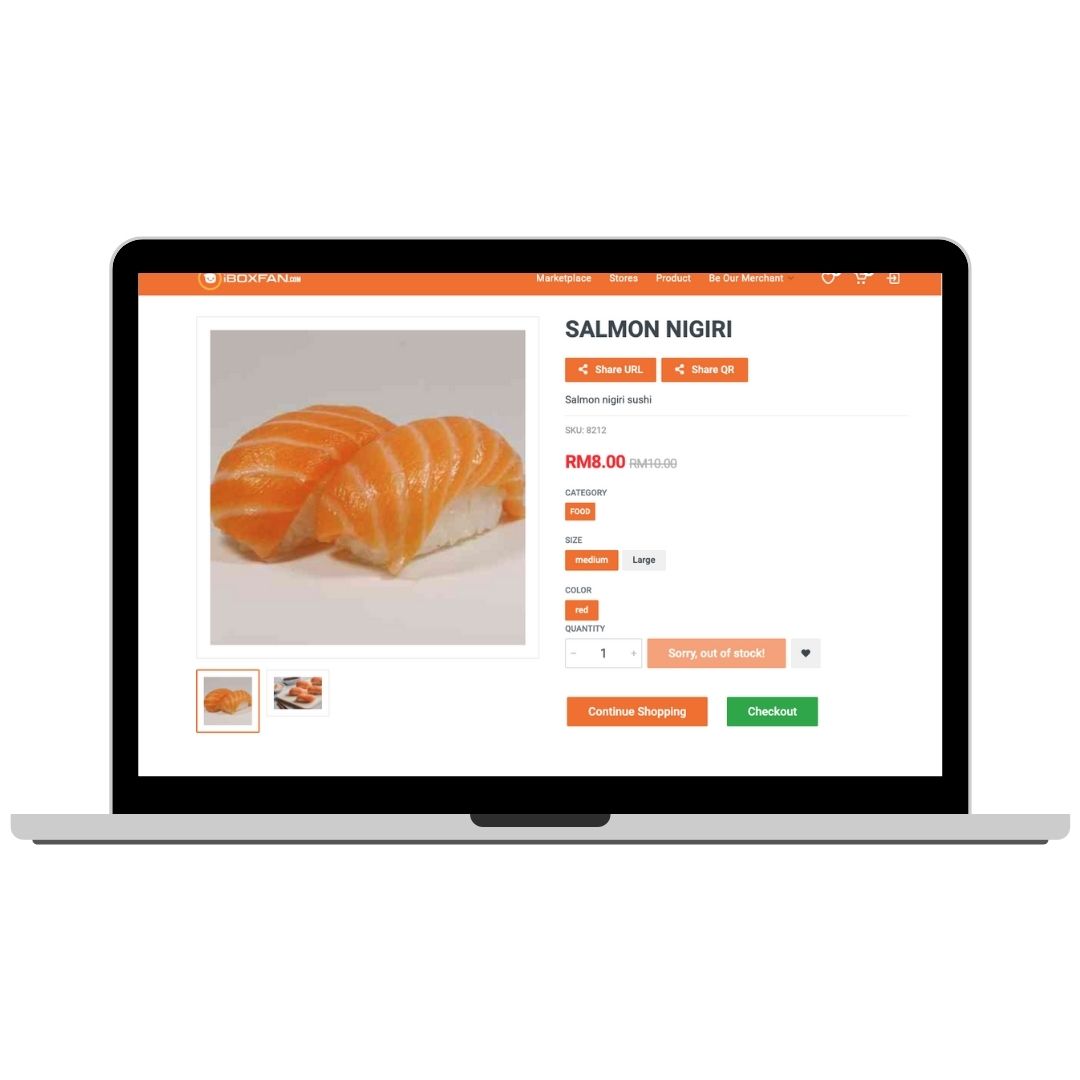

3. O2O Platform

From Offline to Online

- O2O– From Offline to Online, merchants can post product online on shared domain platform

- Customer base– Grow customer base by reaching out customers from multiple sales channels shared on social media platform using URL link

- Delivery– Merchants can arrange delivery through integrated delivery partners

- Payment services– Merchants can receive online payment from FPX interbank transfer, Debit/Credit Cards and BNPL options up to 6 months from selected card issuers

- Membership– Keeps data on customers for engagement

- Affiliates – Merchant can appoint affiliates to share and market product

- Data– Merchants can keep track sale and inventory, and customers data for engagement

Cashless Transaction

Social Pay

By our partner Codebase Technologies

Codebase Technologies

Codebase Technologies (CBT) is a Global Open API Banking solutions provider that enables banks and financial institutions (both Conventional and Islamic) as well as the emerging FinTech ecosystem to Demystify Digital Financial Services.

Codebase helps deliver digital banking at scale, enabling the financial institution to offer hyper-personalized propositions to its customers, including non-traditional (and sometimes non-financial) products and services.

Codebase empowers institutions to deliver digital transformation that goes beyond just software. The institutions then work in tandem to help define the dream of the new enterprise as a living organization—one that self evolves rapidly and adapts to the ever-changing customer needs and behavior.

FIND OUT MORE

Islamic Social Finance

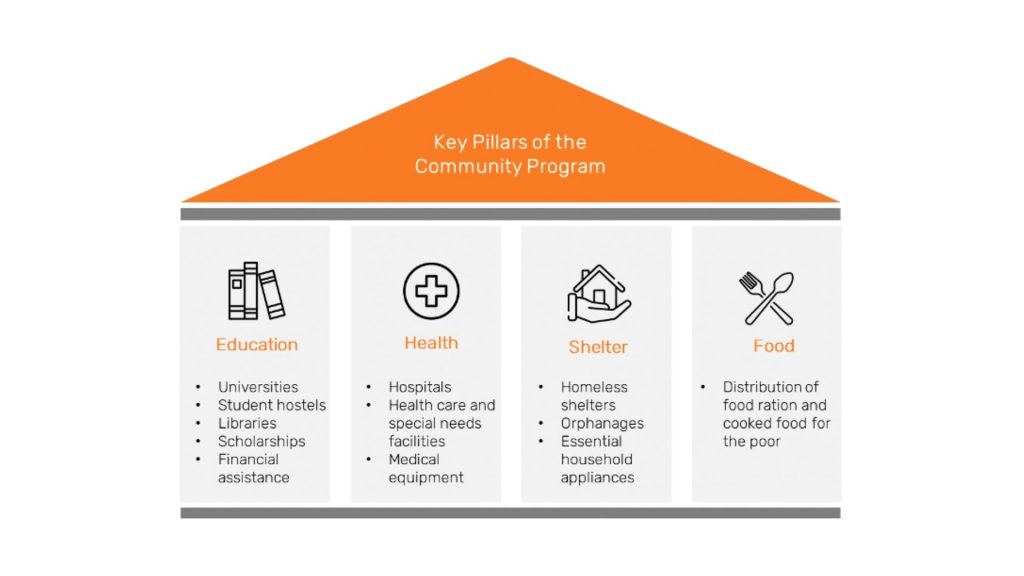

Islamic Social Finance is made of Cash Waqf fund, Donation fund and Zakat accounts governed by an internal Board Shariah Committee that determines the future direction and distribution of the funds, with the objective to serve and empower the community.

Islamic Social Finance would be channelled into welfare and social projects across four key pillars of education, health, shelter and food, and to carry out investment projects that supports the beneficiaries’ disbursements.

Cash Waqf

Cash Waqf fund is an endowment fund used for charitable purposes and can be shared beyond religious, cultural and social boundaries (unless the Waqf has a purpose that is specifically defined by the endowing party).

Waqf is an ongoing sustainable charitable endowment that is used to develop and support communities through empowerment and poverty alleviation. Funds from Waqf management institutions can be contributed from individuals or companies in collaboration with state religious councils or Yayasan Waqf Malaysia.

Donation Fund

The Donation fund is a broad-based donation fund with multi-functional usage across different community initiatives or programs which donors choose to partake in. Donors can choose to (i) donate to a direct fund where the fund is directly disbursed and utilised for a specific charity project across the four focus sectors (education, health, shelter and food), or they can (ii) donate to a general perpetual fund. In line with the underpinning thrusts of BNM’s VBI aspiration, we hope that through these projects, positive, sustainable and impactful outcomes can be realised for the beneficiaries of the fund.

Zakat

Zakat is a wealth redistribution tool that routinely collects designated amounts of public money from Zakat payers to help Asnafs who need it to fulfil their basic daily needs. While 2.5% Zakat on one’s annual cumulative wealth is required by Islam, it is not enforced by the Malaysian law. Zakat is tax deductible which also acts as an incentive to the Zakat payers.

Our digital capabilities can facilitate efficiency and address issues faced by the current system. Some of the ways we can help are as follow:

- Improvement to governance and regulatory framework

- Management of funds and ensuring proper utilisation

- Increase in transparency in channelling the funds to specified beneficiaries